Welcome to create.hsbc

Just so you know, you’ll need to log on or register to see this content.

Design Thinking at HSBC

How our structure helps us solve problems for customers.

Think before you act

Design Thinking is our favourite method for solving problems. It goes through logical steps and sets us up to make improvement after improvement – and do it all with our customers in mind.

We start by pinpointing who we’re trying to help and observing those customers. How do they act? What frustrates them? By paying attention to them, we uncover problems we didn’t know about. Only then do we start testing solutions. We try one and measure the results. If it looks promising, we refine the idea and keep going.

That cyclical process might sound familiar if you’ve come across Design Thinking before. But at HSBC, we’ve made it our own. We’ll explore the specifics of our particular form of Design Thinking later – but first, let’s make the case for Design Thinking overall.

Why businesses should work in cycles

When businesses assume they know best, they make mistakes. They might throw resources at problems that don’t really matter to customers. Or invent solutions that only experts can use.

It’s better to be humble and check with customers. What do they need? What’s getting in the way? These questions should come up constantly in a business that practices Design Thinking. It means they can use their resources to address real needs.

And because the process starts by observing people in the context of their lives, businesses can spot problems they’d miss if they were relying on dashboards or metrics. Instead, they can zoom in on the small, everyday interactions that make up epic customer journeys.

When we describe Design Thinking in this way, it can sound like a lot of work. But actually, this structured process is the most efficient path a business can take from a problem to its solution.

While other companies spend months researching a problem, the Design-Thinking organisation carries out an initial observation, then moves into prototyping. When they trial a solution, they can see what works and what doesn’t, generating more ideas to keep making the solution better. That result is both effective and innovative – an attractive combination!

Imagine the meetings we’d have without Design Thinking

“I’m not quite sure – maybe this is the problem...”

“I can’t see any evidence for that solution at all.”

“Who are we even trying to help here? I’ve lost track.”

At HSBC, we have some extra reasons for using Design Thinking. We’re a large, complex, global business, with more than 200,000 people working in 60 territories. They have countless specialities, areas of expertise, standards and practices. Without a set process for solving problems, they’d get confused and start disagreeing.

Instead, with Design Thinking, they have a common understanding of what they need to do and how they’re supposed to do it. As a bank, it keeps us close to our customers and their interests, too. It leads us to make the kind of changes that polish up our Net Promoter Score.

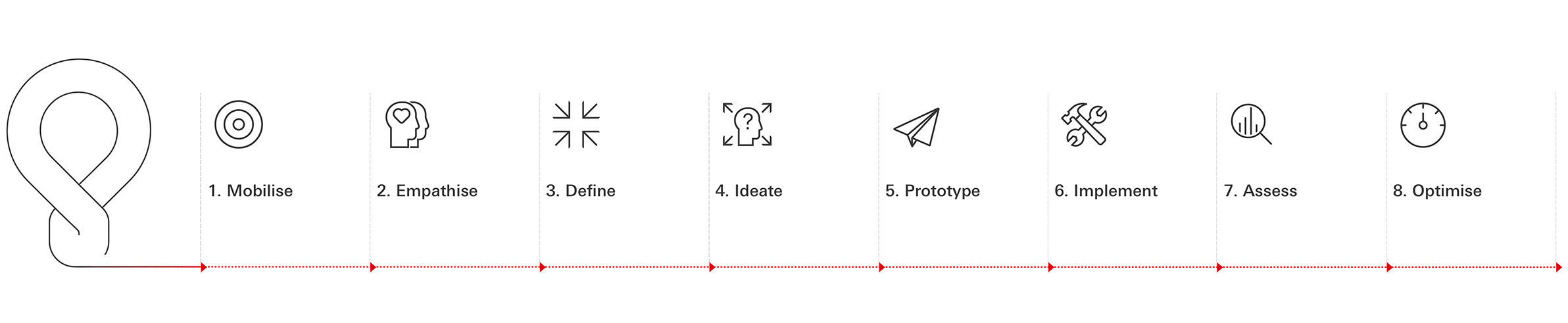

That means we take extra steps (eight, to be precise)

At HSBC, our process for Design Thinking has to apply to projects that involve many different functions. So it’s more elaborate than the basic model you’d find on the internet.

These eight steps are as relevant to the design team drawing up specifications as they are to the IT experts putting them in place. And as you’d hope, we’ve followed our own advice here. We developed this process in-house, with input from a multi-disciplinary group of stakeholders.

It works, whatever your organisation’s size

Our message for the business community is this: big or small, you can practice Design Thinking.

If you’re a start-up, that might mean handing your app to potential customers so they can try a few journeys. It’s okay to be scrappy and learn while you go, as long as you involve users at every stage.

If you’re a multinational corporation, it might mean defining what Design Thinking means for your organisation, then communicating the model and its benefits to your people. That takes more work up-front (we speak from experience), but it’s worth it when you see the change in customer satisfaction.

Explore more

Create Design System

A design community working together to deliver connected products and experiences.

Brand identity

Strengthened, streamlined and simplified; our refreshed brand identity sets us up for success.

Accessible by design

Learn about HSBC’s approach to digital accessibility and what it means to us.